perspectives

Benchmark Mineral Intelligence: Enabling the Energy Transition

We are thrilled to announce our investment in Benchmark Mineral Intelligence, an industry-leading and fast growing price-reporting agency and information services company focused on the lithium-ion battery and electric vehicle (EV) supply chain.

It is rare for Spectrum to have the opportunity to get portfolio exposure to a growth segment as dynamic and consequential as the global energy transition given our narrow business model focus. It is rarer still to be the first institutional investor in a bootstrapped, category leading company like Benchmark, whose comprehensive suite of pricing data, forecast models and industry intelligence are being used in major contract negotiations, infrastructure investment and government policy decisions across the entire lithium EV battery supply chain.

Here’s why we are so excited about this company.

I. Accelerating Adoption of EV Technology

We are entering a new era that will be defined by sustainability. The transition from internal combustion engines to electric vehicles provides a once in a generation growth backdrop for a company like Benchmark.

- Direct exposure to large, fast-growing EV market and energy transition impacting every company in the automotive, energy and mineral materials sectors

- Widespread adoption of EVs remains critical for governments to meet CO2 emission reduction targets

- Massive industry demand for EV materials and dynamic supply chain necessitates high quality forecasts, data and prices to set contracts and execute on corporate strategies

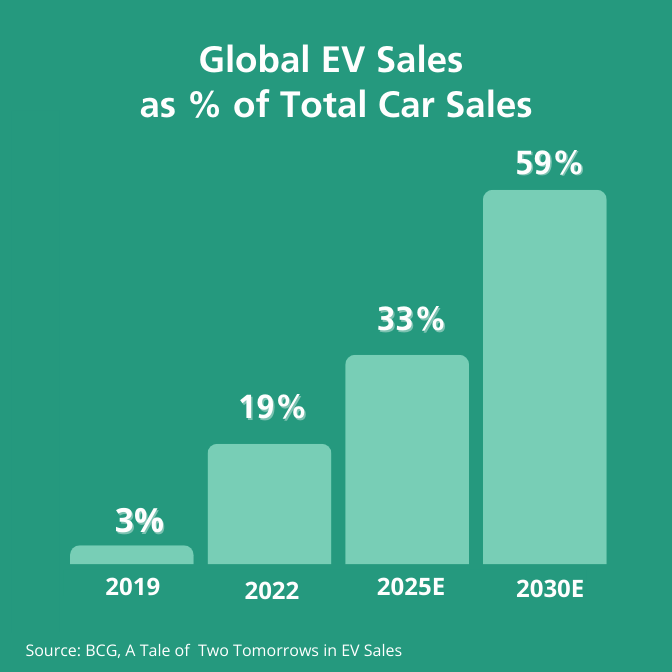

- 3x EV penetration increase over the past 3 years with similar dynamics expected through 2030

II. Leading Research Provider to EV Supply Chain

Spectrum has backed category-defining data and information services companies for nearly 30 years. Underpinning all of them is distinctive and hard-to-get data. Benchmark has spent a decade ‘going deep’ to build and maintain a unique global coverage framework and the granular data needed by all major market participants in the EV supply chain.

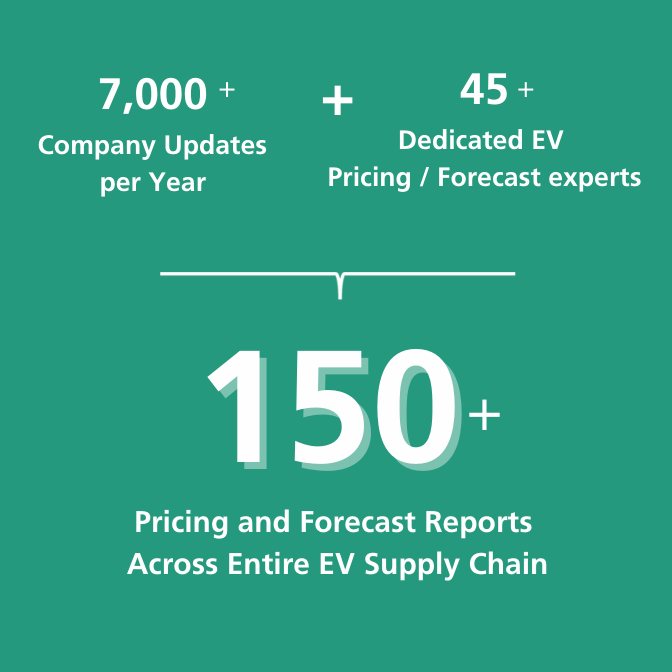

- Largest dedicated pricing and forecast research team focused on the battery supply chain

- Detailed mine/factory level data and forecasts continually validated by 7,000+ conversations between Benchmark analysts and industry market participants annually

- Benchmark is the only Price Reporting Agency (PRA) to achieve Type 2 IOSCO certification across the entire suite of raw materials it covers

III. Blue-Chip Customer Base and Mission Critical Use Cases

Benchmark pioneered research and data coverage of the EV supply chain and built strategic relationships with all major market participants along the way. Benchmark’s customer base today is a ‘who’s who’ list of established market leaders and startup specialists driving innovation.

- A wide variety of subscription customers, including top automotive OEMs, large mining groups, and battery makers

- Benchmark data powers a variety of use cases, spanning early planning (pre-market entry), independent data/forecasts required to secure funding/financing, competitive intelligence tracking and major contract negotiation support

We have deep conviction that Benchmark will play an important role in supporting the energy transition and leading the EV supply chain data category, and we’re thrilled to back CEO Simon Moores, COO Andy Miller and the rest of the Benchmark team around their ambitious growth plans.

If you’d like to learn more about the company, read the press release about Spectrum’s partnership with Benchmark.